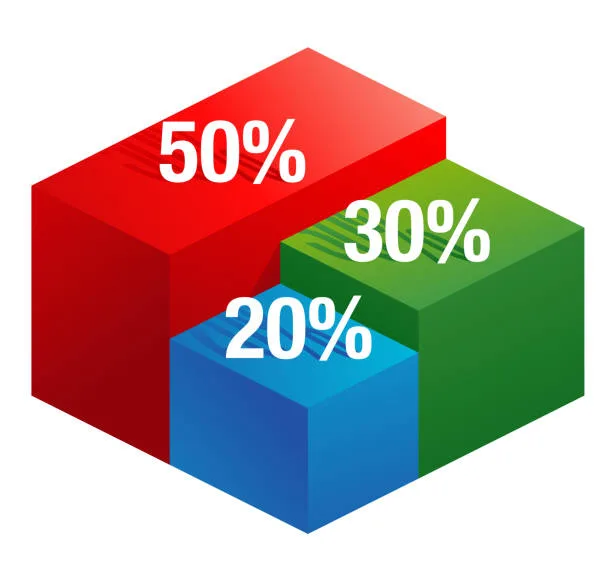

Achieve Financial Power: The 50 30 20 Rule for Success

One of the famous financial Rule 50 30 20 rule

Introduction: Getting to Know the 50:30:20 Rule

Are you having trouble achieving financial stability? Is it difficult for you to establish a balance between spending, saving, and debt repayment? No need to look any further! In this detailed guide, we will look at the financial guideline 50 30 20 rule, a tried-and-true strategy that can drastically improve your financial situation. The 50 30 20 rule provides a straightforward and efficient structure for managing your finances, whether you’re a young professional just starting your career or an experienced individual trying to improve your financial well-being. Let’s take a look at this guideline and see how you may improve your financial status for a better future.

Learn about the 50 30 20 rule financial guideline and how it can assist you in achieving financial balance and stability. Learn how to manage your income, expenses, and savings to ensure a better financial future.

Personal finance management can be a challenging endeavour in today’s fast-paced and ever-changing society. You may, however, reclaim control of your finances and pave the road for a more secure future with a well-defined plan and strategic approach. In this complete guide, we will look at the 50 30 20 rule, which is a basic yet powerful framework for achieving financial success and stability. You will be able to allocate your income effectively, prioritise your financial goals, and make educated decisions that will have a substantial impact on your financial well-being if you follow this guideline.

Recognising the 50:30:20 Rule:

The 50:30:20 rule is a well-known budgeting structure that divides your after-tax income into three categories: needs, wants, and savings. Let’s take a closer look at each category:

1. Needs 50%

The necessities category includes necessary expenses for maintaining a comfortable existence. Housing, utilities, transportation, groceries, healthcare, and insurance are common examples of these costs. Allocating 50% of your income to these important expenses guarantees that you meet your basic needs while also establishing a solid foundation.

2. Wants 30%

Wants are extraneous expenses that improve your quality of life but are not necessary for survival. Dining out, entertainment, travel, hobbies, and luxury things are all examples of this. By putting away 30% of your salary for wants, you give yourself the opportunity to enjoy the results of your labour while keeping your finances in balance.

3. Debt and Savings 20%

Savings and debt reduction are critical to protecting your financial future. By allocating 20% of your income to this area, you can save for retirement, invest in long-term goals, and pay off debts. You lay the groundwork for long-term financial stability and freedom by prioritising savings and debt repayment.

The 50:30:20 Rule Has Many Advantages:

Implementing the 50 30 20 rule guideline can bring several benefits that will help you succeed financially. Let us look at some significant benefits:

- Detailed Budgeting:

The 50 30 20 rule provides a simple and basic budgeting approach. You may quickly change your budget when your revenue fluctuates by designating percentages rather than fixed amounts. This adaptability guarantees that your budget remains realistic and flexible in the face of changing circumstances.

- Prioritisation of financial resources:

You may efficiently prioritise your financial goals by using the 50 30 20 method. You achieve a balance that promotes both short-term happiness and long-term security by ensuring that your necessities are covered, allowing yourself modest indulgences, and constantly investing for the future.

- Debt Control:

The 50 30 20 rules guideline allows you to take control of your debts by allocating 20% of your income to debt reduction. Whether you have school loans, credit card debt, or other financial responsibilities, dedicating a considerable amount of your income to debt repayment helps you lower interest rates and expedite your path to debt-freedom.

- Disaster Preparedness:

Putting together an emergency fund is an important part of financial planning. The 50 30 20 rules approach emphasises conserving a portion of your income as a safety net for unforeseen bills or difficult times. Having an emergency fund provides peace of mind as well as financial security.

- Long-Term Wealth Development:

The 50 30 20 rules allows you to generate long-term wealth through continuous saves and wise investments. You can develop your assets and assure a wealthy future by allocating a percentage of your income to investments such as stocks, bonds, or real estate.

Follow Our Digiknowledge.co.in Page for Latest update about Bikes, Cars, Sports, Government Policy and many more.

What is the Financial Rule 50:30:20?

Financial Rule 50 30 20 Defined

The financial rule 50 30 20 is a budgeting guideline that helps individuals allocate their income wisely to achieve financial balance. It suggests dividing your after-tax income into three categories: needs, wants, and savings. According to this rule, 50% of your income should be allocated to essential needs, 30% to discretionary wants, and 20% to savings and debt repayment.